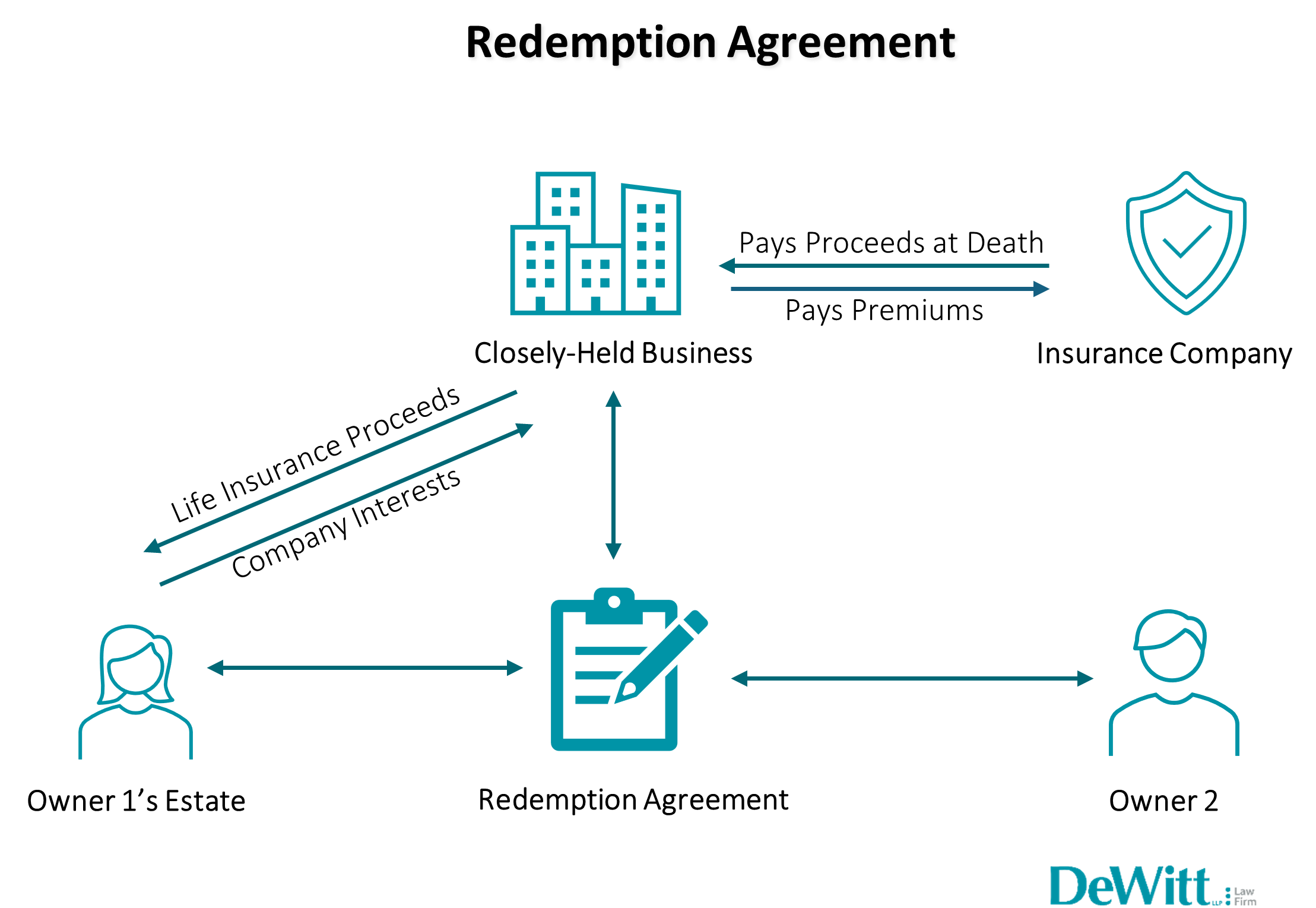

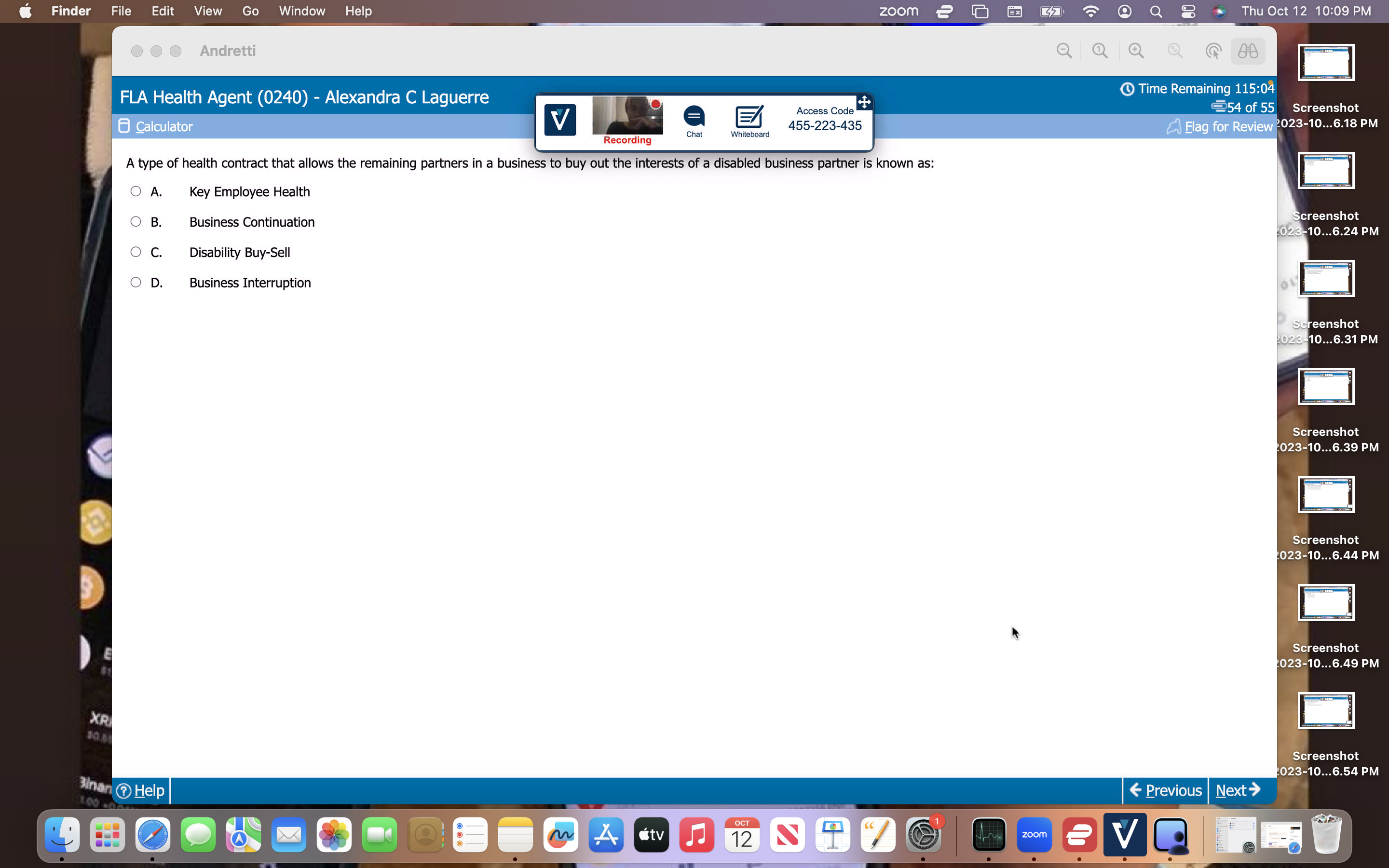

If the owner dies or becomes disabled, the policy would provide which of the. A policy owner would like to change the. With life insurance, the needs. Split dollar plan b. Benefits are taxable to the business entity b. Here’s the best way to solve it. Powered by chegg ai. View the full answer. A) the length of time a disability must last before the remaining partners can buy out the. Which of the following disability buy sell agreement is best suited for businesses with a limited number of partners. To ensure an orderly transfer of your business when you die; To set a value on the business for transfer and.

Related Posts

Recent Post

- Osceola County Inmate Records

- Statesman Journal Salem Oregon Obits

- Broward County Sheriff Inmate Search

- Indeed Jobs Weekend Only

- Temple Of Umi Aya Healing Church Retreat

- Osceola County Inmate List

- Indeed Los Angeles Ca

- Urgent Hire Jobs

- Beltrami County Mn Jail Inmate List

- Wausaw Homes

- Petsmart Job Openings

- Crooks Death Pictures

- Post Tribune Obituaries Gary

- Amazon Driver Hiring

- Celebrity Women Photos

Trending Keywords

- Northern Property Care Taker Jobs

- Nyu Academic Calendar

- Beaver County Times Obituaries For Today

- Pictures Of Dead Shooter

- Osceola County Inmate Records

- Statesman Journal Salem Oregon Obits

- Broward County Sheriff Inmate Search

- Indeed Jobs Weekend Only

- Temple Of Umi Aya Healing Church Retreat

- Osceola County Inmate List

Recent Search

- Customer Service Representative National Remote

- General Hospital Soap She Knows

- Young Miami

- Kathy Gerrity Doocy

- Calcasieu Parish Correctional Center

- Walmart Careers Online Application

- Star Gazette Obituary

- Sebastian County Inmate Search

- Slater Funeral Home Brentwood Obituaries

- Market Place Mn

- Thurston County Jail Roster

- Jalen Washington 247

- Northern Property Care Taker Jobs

- Nyu Academic Calendar

- Beaver County Times Obituaries For Today

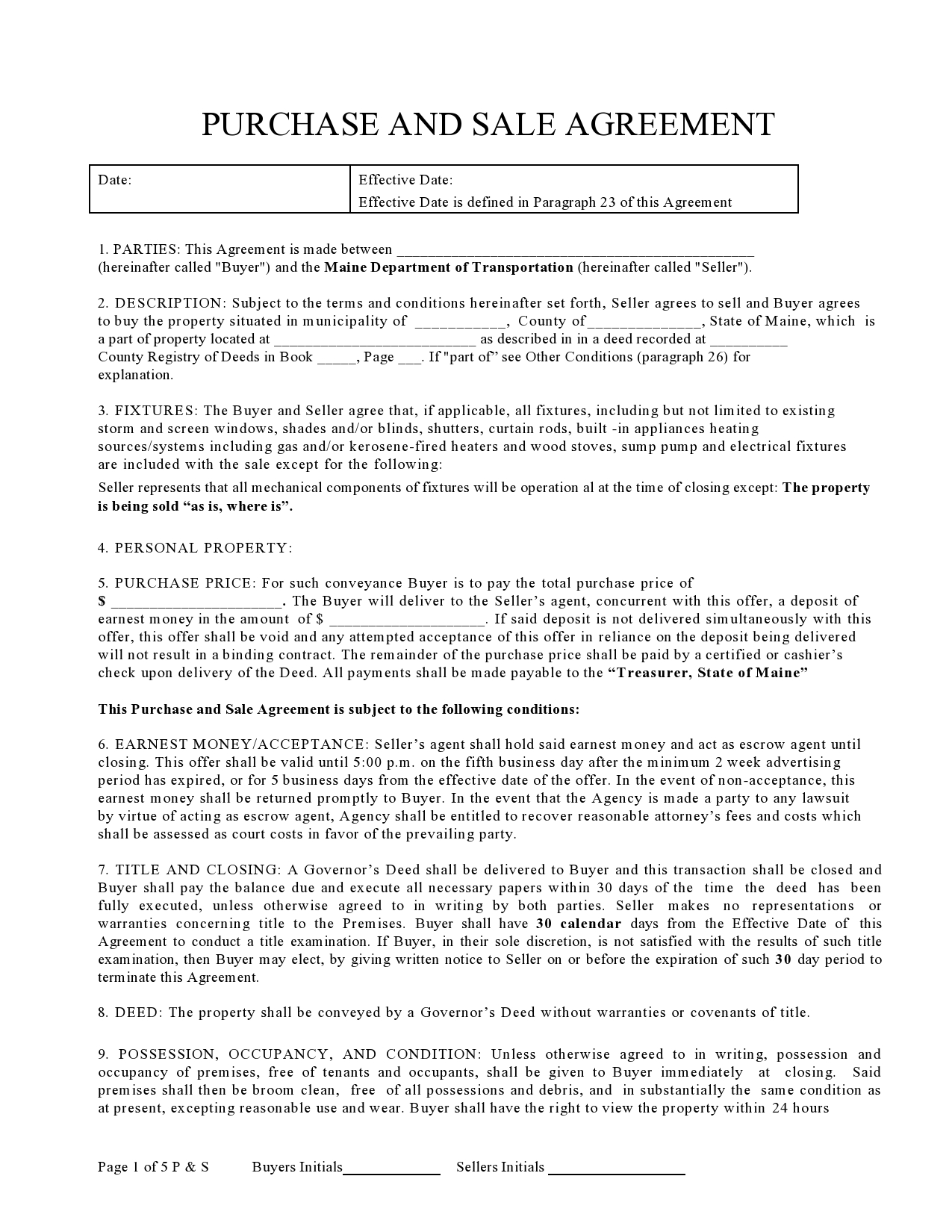

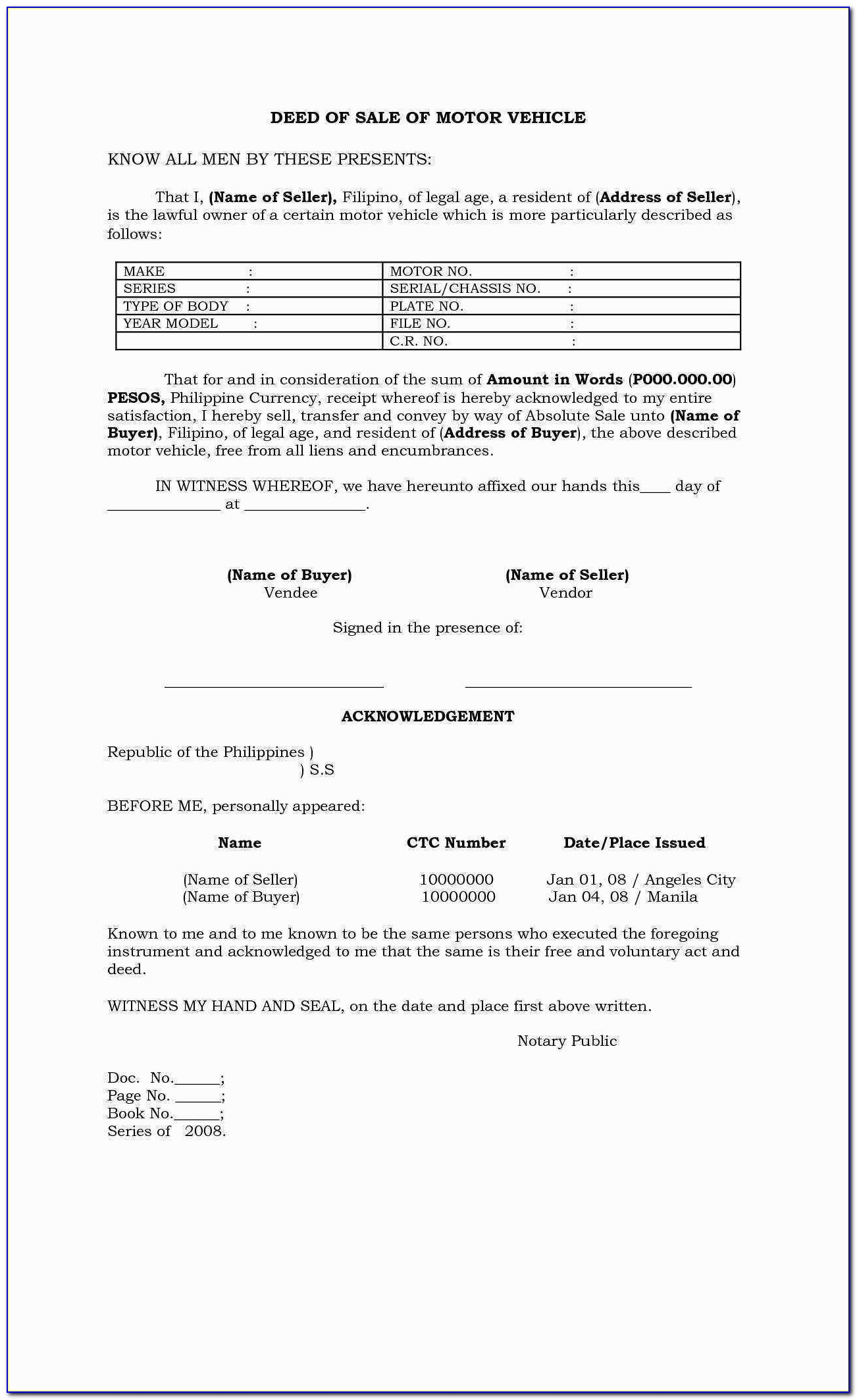

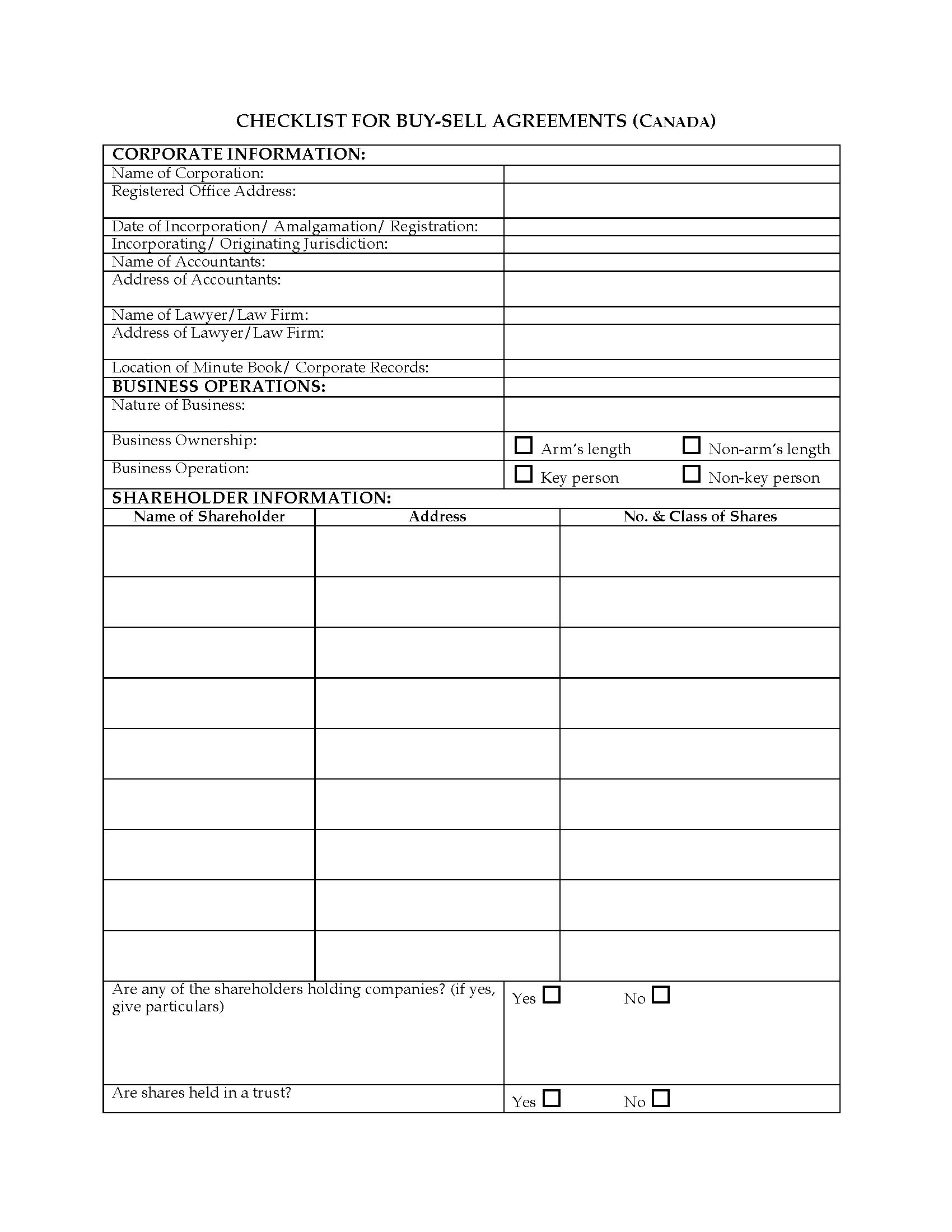

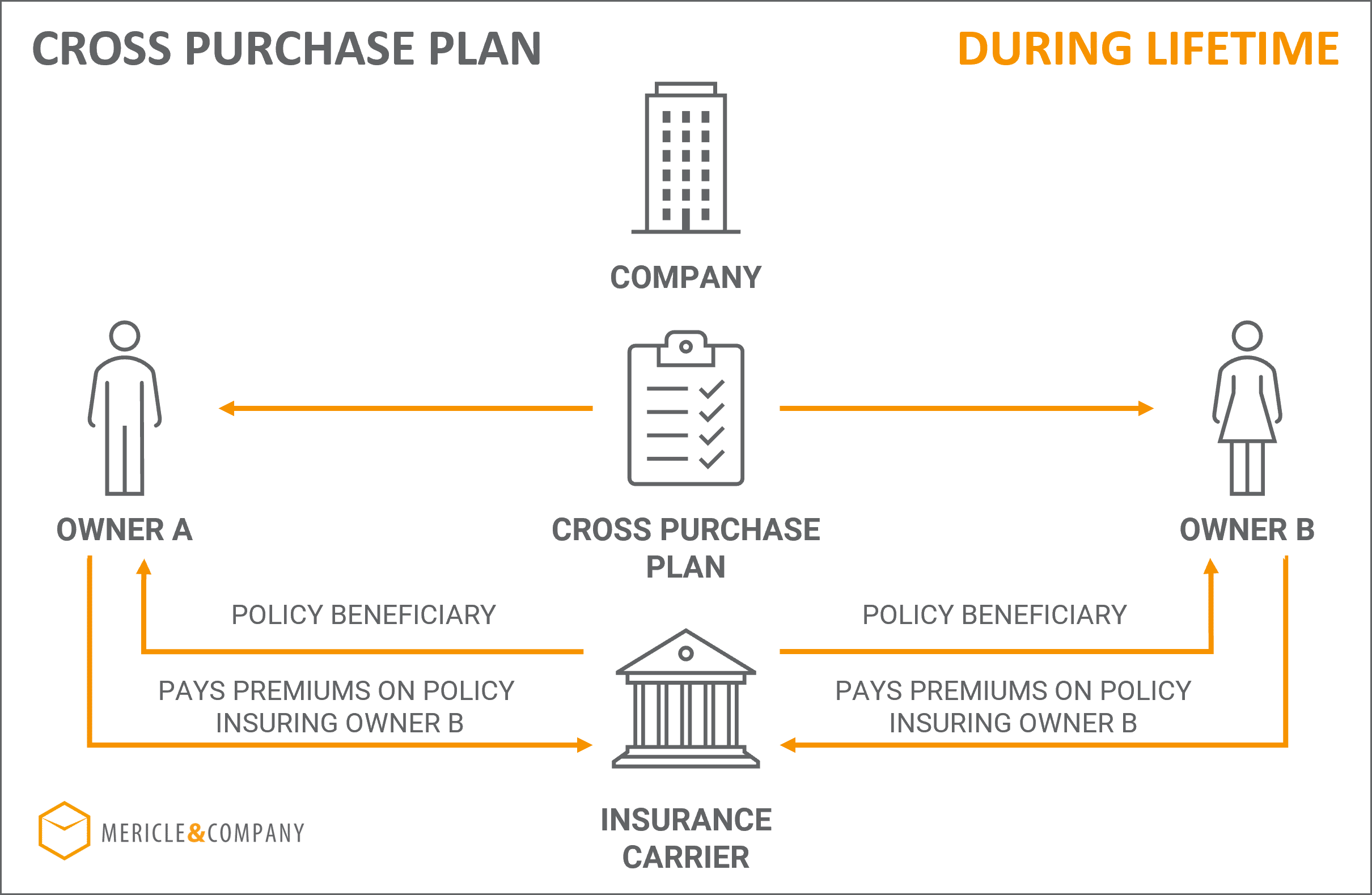

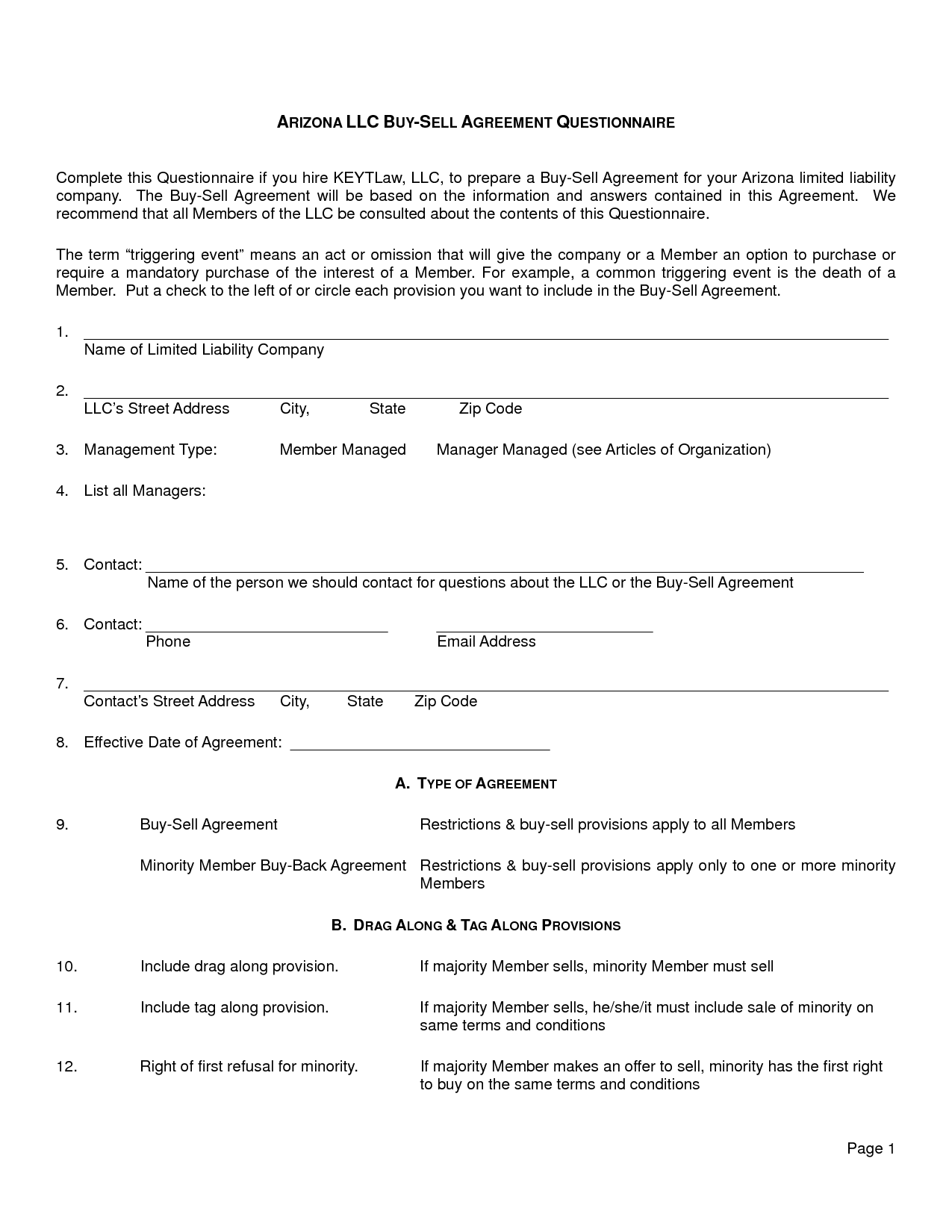

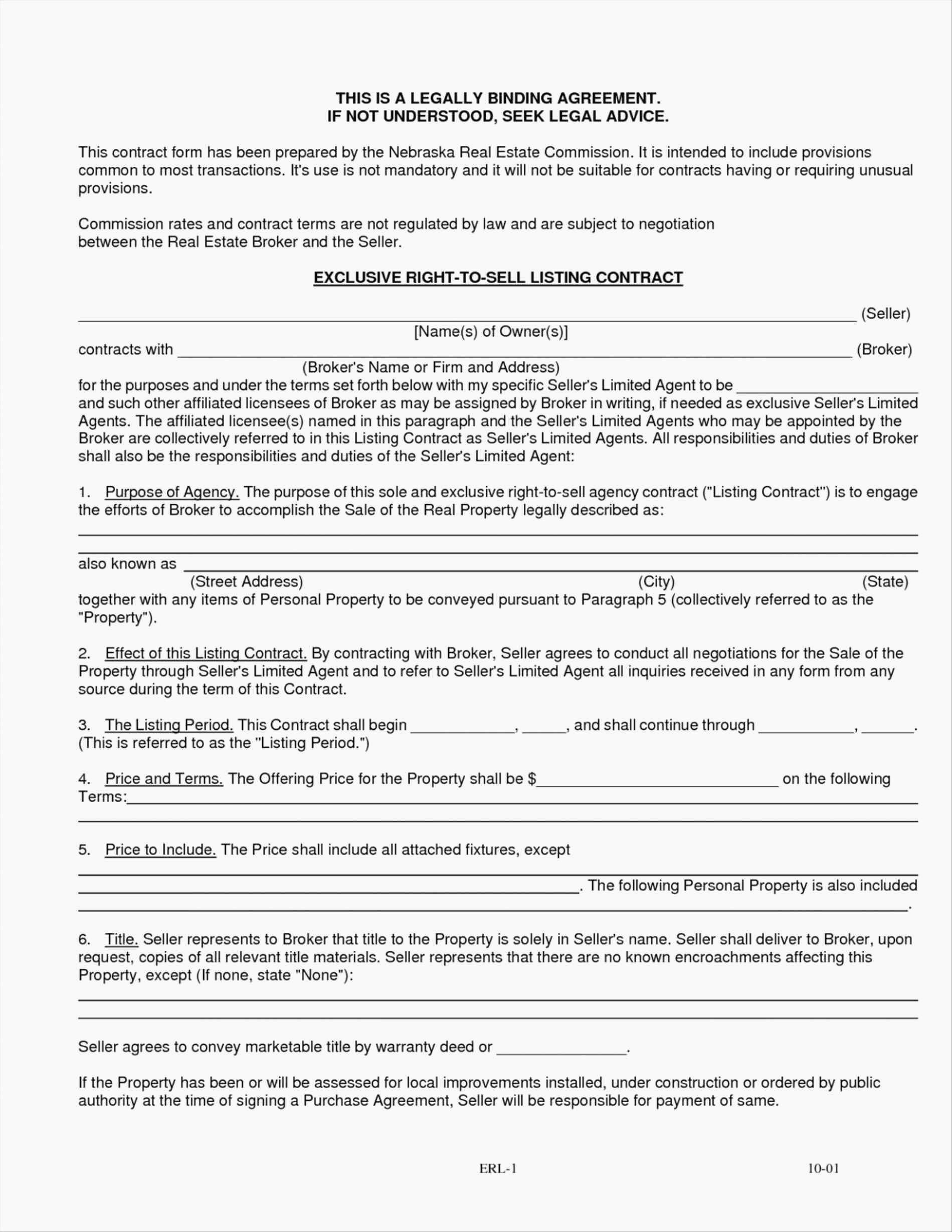

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-PDF-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Word-Document.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Template-of-Buy-Sell-Agreement-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Blank-Form-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Formatted-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Document-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Example.jpg)